montana sales tax rate change

The Call Center always does a good job helping when I call for assistance with my tax return. These two taxes are a.

States Without Sales Tax Article

Ad Lookup State Sales Tax Rates By Zip.

. The first day of the month following 30 days from adoption by the city or borough. Download tax rate tables by state or find rates for individual addresses. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the.

Montana does not levy a sales tax so there is no requirement for remote sellers to collect and remit it. Get Your First Month Free. Gianforte tax reform changes.

The 2022 state personal income tax brackets. We can also see the progressive nature of Montana state income tax rates from the lowest MT tax rate bracket of 1 to the highest MT tax rate bracket of 675. Gianforte signed another companion bill that cuts taxes for the top marginal tax rates from 69 to 675 in 2022 and.

Typically the PJ rate tax levied in the PJ will be one-half the regular tax rate. Vehicle owners to register their cars in Montana. Sales Tax Breakdown.

This reduction begins with the 2022 tax year. Ad Should Your Business Change Their State Residency. While Montana has no statewide sales tax some municipalities and cities especially large tourist.

The Montana Department of Revenue administers the states licensing distribution and taxation on Alcoholic Beverages. Get Your First Month Free. 4214101 ARM through 4214112 ARM and a 3 lodging facility sales tax see 15-68-101 MCA through 15-68-820 MCA for a combined 7 lodging facility sales and.

368 rows There are a total of 68 local tax jurisdictions across the state collecting an average. I know they probably take. How State Tax Rates Can Reduce the Bottom Line for Asset Management Firms.

Department of Revenue Call Center. You can learn more about licensing and distribution from the Alcoholic. Over the past year there have been 98 local sales tax rate changes in Missouri.

Because there is no sales tax in the state and several counties also do not levy a local option tax the cost of registering luxury vehicles here. Download our Tax Rate Lookup App to find Washington sales tax rates on the go wherever your business takes you. The December 2020 total local sales tax rate was also 0000.

The highest tax rate will decrease from 69 to 675 on any taxable income over 19800. PJ Police Jurisdiction Rate. The recent Montana tax reform package made several changes to individual and corporate taxes.

Senate Bill 399 passed during the 67 th Montana Legislative Session made several changes to Montanas. Senate Bill 399. Simplification of Montana Income Taxation.

Alaska Remote Seller Sales Tax Commission Economic Nexus Rules. Ad DAVO Sets Aside Files Pays Your Sales Tax On Time So You Can Focus On Your Business. Download tax rate tables by state or find rates for individual addresses.

The bill will eliminate 23 tax credits in the process. Our mobile app makes it easy to find the tax. Ad Lookup State Sales Tax Rates By Zip.

Look up a tax rate on the go. Ad Should Your Business Change Their State Residency. Free Unlimited Searches Try Now.

Montana is one of the five states in the USA that have no state sales tax. Learn more about the Gov. Before the official 2022 Montana income tax rates are released provisional 2022 tax rates are based on Montanas 2021 income tax brackets.

Get the Latest Insights from EY. Sales tax rates for items like. From 500000 down to 100000.

Lodging Facility Sales and Use Tax Guide Page 1 What is the Lodging Facility Sales and Use Tax. RC - Rate Change. How State Tax Rates Can Reduce the Bottom Line for Asset Management Firms.

Get the Latest Insights from EY. Only Oregon Montana New Hampshire Alaska and Delaware dont. There are two taxes imposed on users of an overnight lodging facility.

Free Unlimited Searches Try Now. Ad DAVO Sets Aside Files Pays Your Sales Tax On Time So You Can Focus On Your Business. The majority of states45 and the District of Columbia as of July 2021impose a sales tax at the state level.

NT - New Tax. The current total local sales tax rate in Whitehall MT is 0000. AC - Agency Change.

They are always kind and efficient. Montana currently has seven.

Use This Sales Tax Calculator To Figure Sales Tax Or Vat Gst At A Rate Of 7 75 Free To Download And Print Tax Printables Sales Tax Tax

Sales Tax By State Is Saas Taxable Taxjar

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Montana Sales Tax Rates By City County 2022

How High Are Sales Taxes In Your State Tax Foundation

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes

States Without Sales Tax Article

U S States With No Sales Tax Taxjar

California Sales Tax Small Business Guide Truic

Montana State Taxes Tax Types In Montana Income Property Corporate

How Is Tax Liability Calculated Common Tax Questions Answered

State And Local Sales Tax Rates 2013 Map Property Tax Income Tax

How Do State And Local Sales Taxes Work Tax Policy Center

How Do State And Local Sales Taxes Work Tax Policy Center

Updated State And Local Option Sales Tax Tax Foundation

Madison County Sales Tax Department Madison County Al

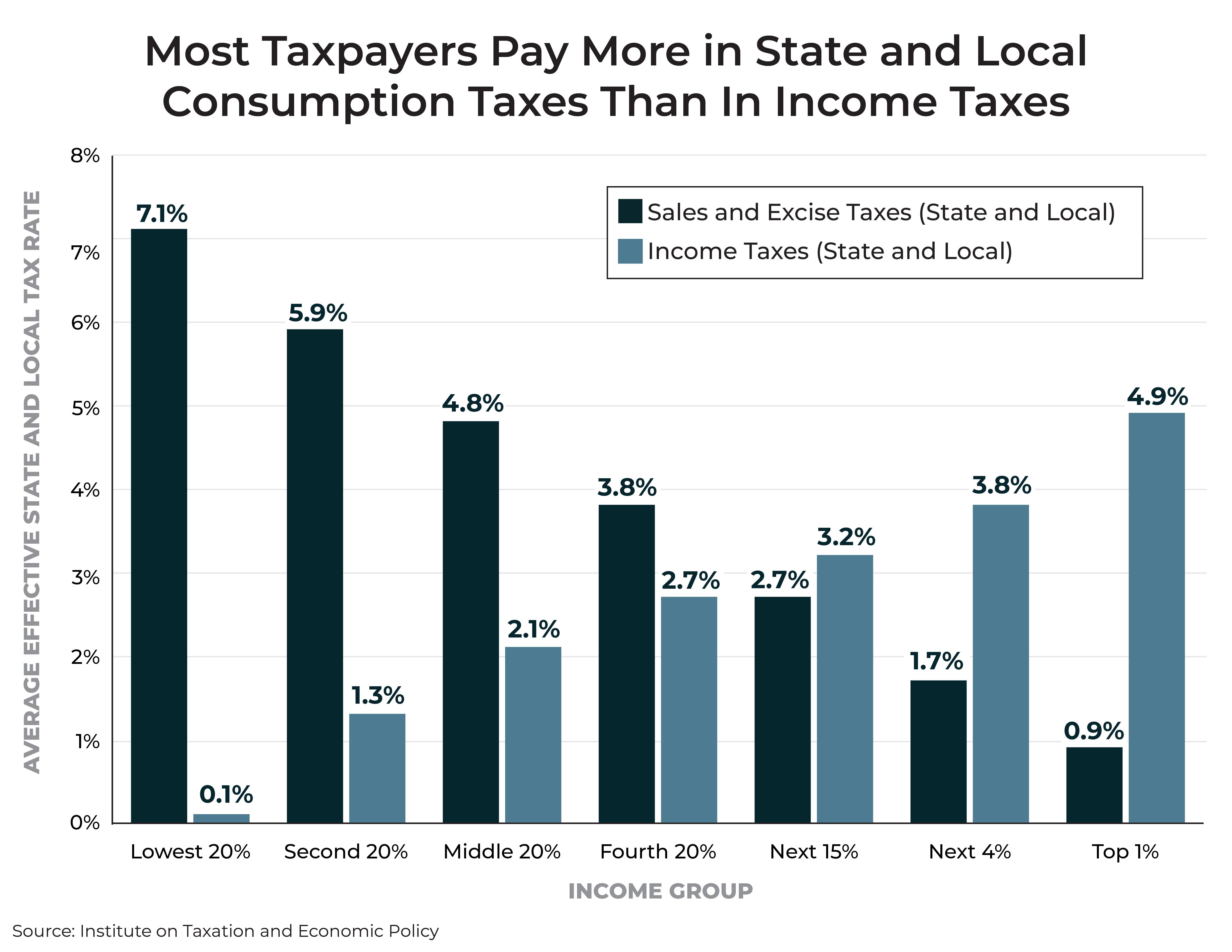

Fairness Matters A Chart Book On Who Pays State And Local Taxes Itep