inheritance tax calculator florida

Inheritance tax is imposed on the assets inherited from a deceased person. Florida has no estate or inheritance tax and property and sales tax rates are close to national marks.

Secured Property Taxes Treasurer Tax Collector

How much can you inherit without paying taxes in 2020.

. The exemption is 117 million for 2021 Even then youre only taxed for the portion that exceeds the exemption. There is no inheritance tax in Florida but other states inheritance taxes may apply to you. In most cases rates begin in the single digits and rise to between 15 and 18.

To find a financial advisor near you try our free online matching tool. Estate and gift taxes the congressional budget office noted raised only about 14 billion in federal revenue in. Enter your financial details to calculate your taxes Add Pension You will pay 0 of Florida state taxes on your pre-tax income of 40000 Your Tax Breakdown Federal 1731.

In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth more than 1158 million. The tax rate on inheritances depends on. The federal estate tax only applies if the value of the entire estate exceeds 12060000 million 2022 and the tax thats incurred is paid out of.

Just because Florida lacks an estate or inheritance tax doesnt mean that there arent other tax filings that an. Over 13M Americans Filed 100 Free With TurboTax Last Year. The estate would pay 50000 5 in estate taxes.

Enter your financial details to calculate your taxes Add Pension You will pay 0 of Florida state taxes on your pre-tax income of 40000 Your. There is no estate. Select Popular Legal Forms Packages of Any Category.

The tax rate varies depending on the relationship of the heir to the decedent. Ad File Your State And Federal Taxes With TurboTax. If your parent owned the house for a very long time then the property taxes will go up a lot.

Enter your financial details to calculate your taxes Add Pension You will pay 0 of Florida state taxes on your pre-tax income of 40000 Your Tax Breakdown Federal 1731. There is no inheritance tax in Florida but other states inheritance taxes may apply to you. Floridas state sales tax is 6 and with local sales tax ordinances the total sales tax can climb as high as 85.

Property taxes in Florida have an average effective rate of 083 in the middle of the pack nationally. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. See Why Were Americas 1 Tax Preparer.

Inheritance Tax Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. See the division of an intestate estate and how much of each heir will receive. Each user response is evaluated in comparison with the applicable intestate laws and all prior responses to determine the most relevant information that must be solicited next to determine the legal heirs of the current estate as.

The rates for Pennsylvania inheritance tax are as follows. You would pay 95000 10 in inheritance taxes. All Major Categories Covered.

That and Floridas tropical climate are why its the most popular retiree destination in the US. Second the income taxes from the sale of the house will not be too bad. Among the 3780 estates that owe any tax the effective tax rate that is the percentage of the estates value that is paid in taxes is 166 percent on average.

The federal government however imposes an estate tax that applies to all United States Citizens. Heres how estate and inheritance taxes would work. Federal Estate Taxes.

When an inheritance tax is levied it is only applied to the fraction of the estate that surpasses the exempt amount. Some states and a handful of federal governments around the world levy this tax. What are the tax implications of inherited property in Florida.

As mentioned Florida does not have a separate inheritance death tax. Find Everything about Florida inheritance tax and Start Saving Now. You would receive 950000.

Ad Look For Florida Inheritance Tax Now. First the property taxes will go up if you inherited the persons homestead and you have your own homestead.

Inheritance Tax Here S Who Pays And In Which States Bankrate

A Guide To Estate Taxes Mass Gov

Does Florida Have An Inheritance Tax Alper Law

401 K Inheritance Tax Rules Estate Planning

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

![]()

Does Florida Have An Inheritance Tax Alper Law

Do I Have To Pay Taxes When I Inherit Money

Does Florida Have An Inheritance Tax Alper Law

It S Weekend Yaay Time To Take Stock And Be Thankful For The Past Week Have A Lovely One Accounting And Finance Academy The Past

Https Www Iii Org Article How To Save Money On Your Homeowners Insurance Home Buying Process Home Equity Loan Home Equity

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Tax Cartoons Cartoons About Taxes Glasbergen Cartoon Service

Does Florida Have An Inheritance Tax Alper Law

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

2022 Property Taxes By State Report Propertyshark

Estate Tax Definition Who Pays

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

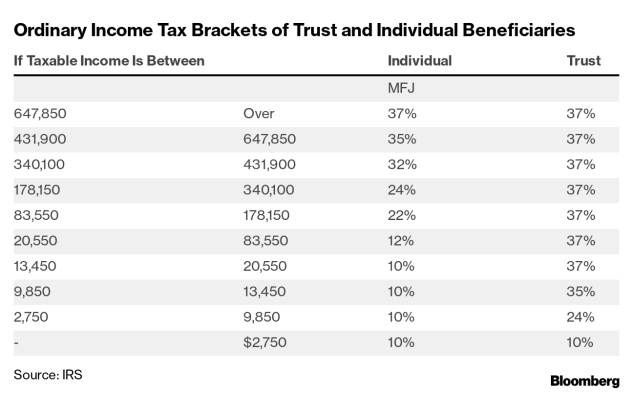

Income Tax Challenges And Smart Planning For Irrevocable Trusts 1